Mpowa Finance

«Mpowa Finance» - Loan company summary:

MPOWA Finance is a prominent online microfinance company operating within the South African financial landscape. Specializing in payday loans, MPOWA Finance offers a convenient and swift solution for individuals facing unexpected financial challenges. With their streamlined application process, clients can access much-needed funds quickly and easily.

Mpowa Finance is a financial institution in South Africa that offers short-term loans with a repayment period of up to 45 days. These types of loans are often referred to as payday loans or short-term installment loans, and they are designed to provide individuals with quick access to funds for short-term financial needs.

One of the standout features of MPOWA Finance is their rapid approval and disbursement system. By submitting your loan application before 1 pm, you stand the chance of having between R500 to R2500 deposited directly into your bank account by 5 pm on the very same day. This expedited service is particularly valuable for individuals confronted with urgent expenses, such as medical bills, car repairs, or unforeseen emergencies.

Repayment of the loan is equally straightforward, as MPOWA Finance employs an automatic debit order system. This means that on your next payday, the loan amount, along with any applicable fees or interest, will be deducted directly from your bank account. This not only simplifies the repayment process but also sets you up for the possibility of qualifying for a new loan in the future.

The convenience and accessibility of MPOWA Finance’s payday loans have made them a popular choice for South Africans seeking short-term financial assistance. However, it’s important for borrowers to be fully aware of the terms, interest rates, and fees associated with these loans. It’s advisable to carefully assess your financial situation and ensure that you can comfortably manage the repayment on your next payday.

Furthermore, MPOWA Finance is just one option among many lenders in the market. Before committing to any loan agreement, it’s a prudent practice to compare offers from different financial institutions to find the best fit for your specific financial needs and circumstances. Additionally, staying informed about your rights and responsibilities as a borrower in South Africa is essential to make informed financial decisions.

Is Mpowa Finance a Legit?

Yes, Mpowa Finance is a legitimate and registered financial institution in South Africa. It holds the registration number NCRCP6666 with the National Credit Regulator (NCR). For consumers seeking financial services, this registration provides a level of assurance and peace of mind that they are dealing with a reputable and legitimate financial institution. It means that Mpowa Finance is subject to regulatory oversight and must adhere to responsible lending practices and consumer protection regulations.

MPOWA requirements

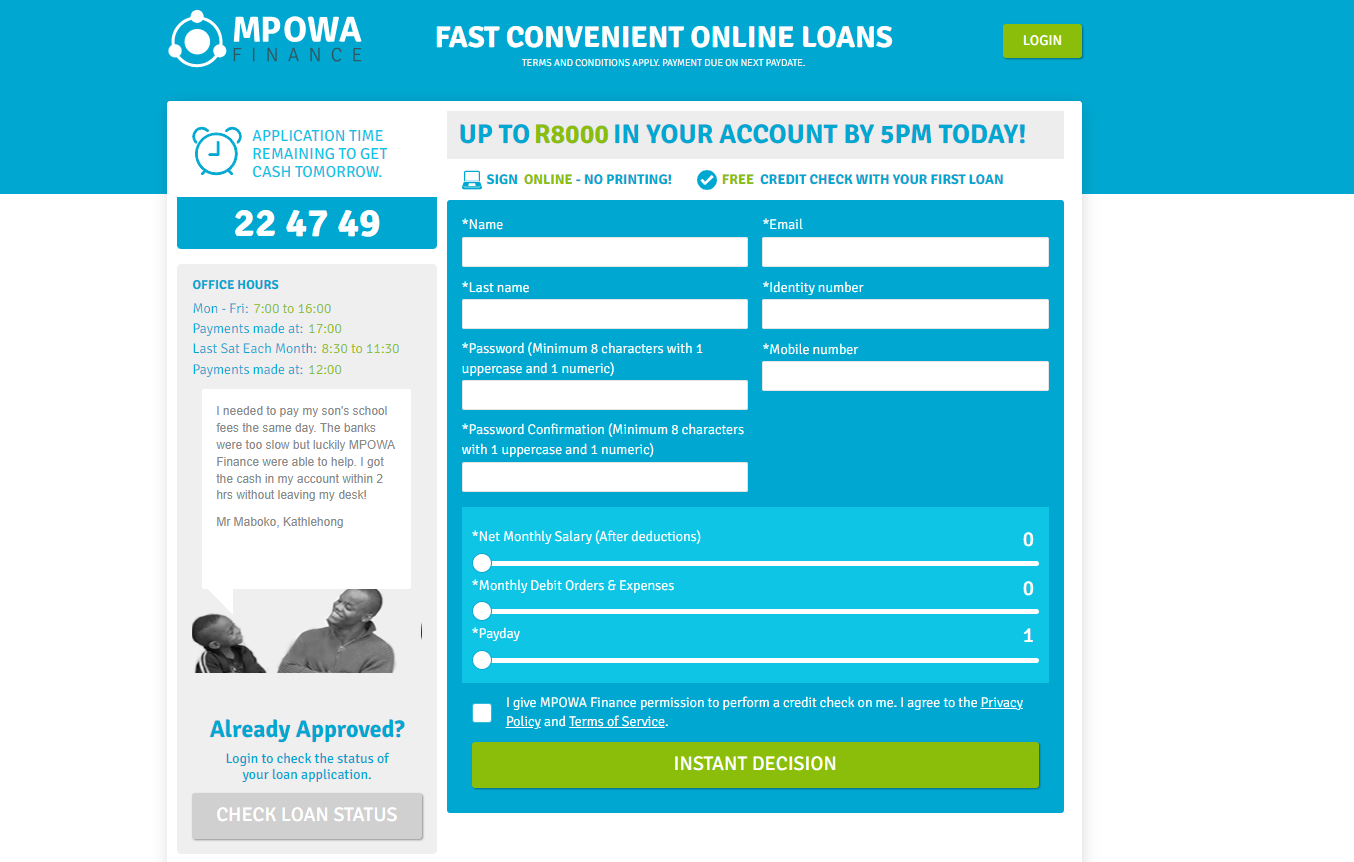

MPOWA Finance, operating exclusively within South Africa, has specific requirements and criteria to ensure that their loan offerings are accessible to eligible individuals. To help potential borrowers navigate the application process, here’s a comprehensive look at the documents and affordability considerations involved:

Eligibility Criteria:

- South African Citizenship: To be eligible for MPOWA Finance loans, you must be a South African citizen. This requirement is essential, and you will need to provide proof of your citizenship.

- Age Requirement: Borrowers must be 18 years of age or older to qualify for MPOWA Finance loans.

- National Identification: Ensure that you have your National Identification card or booklet. This document is necessary for verifying your identity. Be prepared to provide your ID number, along with other contact details such as your cellphone number and email address.

MPOWA Finance employs an affordability assessment to determine the loan amount that a borrower can qualify for. This assessment relies on several key factors:

- Monthly Salary: You will be asked to disclose your monthly income, specifically your net salary, which is the amount that gets deposited into your bank account after deductions. This income serves as a fundamental component of the affordability assessment.

- Monthly Expenses: You will need to detail your monthly expenses, encompassing various categories such as rent or mortgage payments, food, groceries, clothing, and any school fees. Providing an accurate breakdown of your expenses is crucial for the assessment.

- Outstanding Loans and Deductions: MPOWA Finance takes into account any existing loans and associated debit orders that you may have. These financial commitments are subtracted from your net salary to determine your disposable income.

- Bank Statements: If you choose to apply using bank statements, it’s essential to provide statements for at least the three months preceding your loan application date. These statements offer a comprehensive view of your financial history and help in assessing your affordability.

Your outstanding balance after accounting for income, expenses, and existing loan repayments primarily influences the loan amount and principal that you qualify for. If you have a significant amount of disposable income left after all deductions, you are likely to be eligible for higher loan amounts, whereas a lower disposable income may result in a lower loan approval.

It is essential to note that when applying for a loan with MPOWA Finance, honesty and accuracy are crucial. The terms and conditions explicitly state that the information provided must be “true, correct, and complete.” Providing accurate details about your financial situation ensures a fair and responsible assessment of your loan application.

MPOWA Finance’s application process involves verifying your eligibility as a South African citizen, assessing your income, expenses, and outstanding financial commitments to determine the loan amount you qualify for. Being prepared with the necessary documents and ensuring transparency in your application will contribute to a smooth and reliable borrowing experience.

How Mpowa Finance Works

Mpowa Finance offers a straightforward and efficient process for obtaining personal loans in South Africa. Whether you’re a first-time customer or a returning borrower, understanding how Mpowa Finance works can help you navigate the application and repayment process effectively.

Loan Application

- For First-Time Customers: If you’re applying for a Mpowa Finance personal loan for the first time, you’ll need to create an account on their platform. This typically involves providing your personal information and contact details.

- Returning Customers: If you’ve successfully repaid a previous loan with Mpowa Finance and wish to borrow again, simply log in to your existing account and initiate a new loan application.

- Application Deadline: To ensure same-day loan processing, applications must be submitted by 3 PM. This deadline is essential for those seeking quick access to funds.

Signing and Document Submission

- Loan Contract: Once your loan application is approved, Mpowa Finance will email you a loan contract. It’s crucial to review the contract carefully, as it outlines the terms and conditions of the loan, including interest rates and repayment details.

- Document Submission: To complete the application process, you’ll need to sign the loan contract and submit it, along with your three most recent payslips or bank statements. This step helps verify your financial status and ensures responsible lending practices.

Cash Transfer

- Verification Call: After receiving your signed loan contract and supporting documents, Mpowa Finance may initiate a verification call. During this call, they will record details of your loan contract to ensure accuracy and compliance.

- Prompt Cash Transfer: Following successful verification, the approved loan amount is typically disbursed to your bank account by 5 PM on the same day. This quick turnaround time is one of Mpowa Finance’s key advantages.

Repayment

- Debit Order Authorization: Repayment of the loan is typically scheduled for your next payday. You’ll need to sign a debit order authorization, which allows Mpowa Finance to automatically deduct the total loan amount, including interest and fees, from your bank account.

- Credit Score Implications: It’s crucial to fulfill the agreed-upon repayment terms. Failing to do so can have serious consequences for your credit score and financial standing. Responsible and timely repayment is essential to maintaining a positive credit history.

In summary, Mpowa Finance provides a user-friendly online platform for individuals in South Africa to access personal loans quickly. Their same-day loan processing, efficient document submission, and automatic repayment through debit orders streamline the borrowing experience. However, borrowers should exercise responsible financial management to ensure timely repayments and avoid adverse effects on their credit scores.

| Pros | Cons |

| Speedy Loan Disbursement: One of the notable advantages of Mpowa Finance is its lightning-fast loan processing. When you submit your application, there’s a possibility of having the requested funds in your account by 5 PM on the very same day. This quick turnaround time can be a lifeline for individuals facing sudden financial needs or emergencies. | Employment Duration Requirement: One notable limitation of Mpowa Finance is that loan approval is typically granted to individuals who have been employed at their current job for at least three months. This requirement may exclude newly employed individuals from accessing their services. |

| Loan Amount Increase: Mpowa Finance rewards responsible borrowers. By successfully repaying three loans, you unlock the opportunity to borrow larger amounts, often up to R5000. This feature can be especially beneficial for those who may require more substantial financial assistance over time. | Limited Loan Options: Mpowa Finance primarily operates as a short-term loan lender. Consequently, borrowers may face restrictions in terms of loan amount and repayment terms. While other personal loan providers in South Africa may offer loans of up to R250,000 over extended periods, Mpowa Finance’s offerings may not be suitable for larger financial needs or long-term financing goals. |

| Convenient Online Application: Mpowa Finance eliminates the need for tedious bank visits and cumbersome paperwork. The entire loan application process is conducted online, from filling out the initial form to signing the loan contract electronically. Plus, you have the convenience of having the loan amount delivered to your preferred location. | |

| Transparent Fee Structure: Mpowa Finance takes transparency seriously. Each loan offer provided includes a clear breakdown of fees, prominently displayed on the quotation page. This transparency empowers borrowers to make informed decisions based on their budget and financial capacity. |

On the partner site

Best MFOs

:

: